The Kenya Revenue Authority (KRA), is implementing strategic measures to ensure that there is sustainable revenue collection by modernising operations, Intensifying Crackdowns, tapping on sectors that were not levied before among other Measures, in a bid to meet revenue targets.

These Moves, will see the Common Kenyan However, Dig deeper into their Pocket, Comply with Taxation Measures Or Face Penalties and Jail term. Here are some of the measures the Authority has taken.

The Taxman, has introduced two new departments to enhance tax compliance, targeting both small traders and technological innovation.

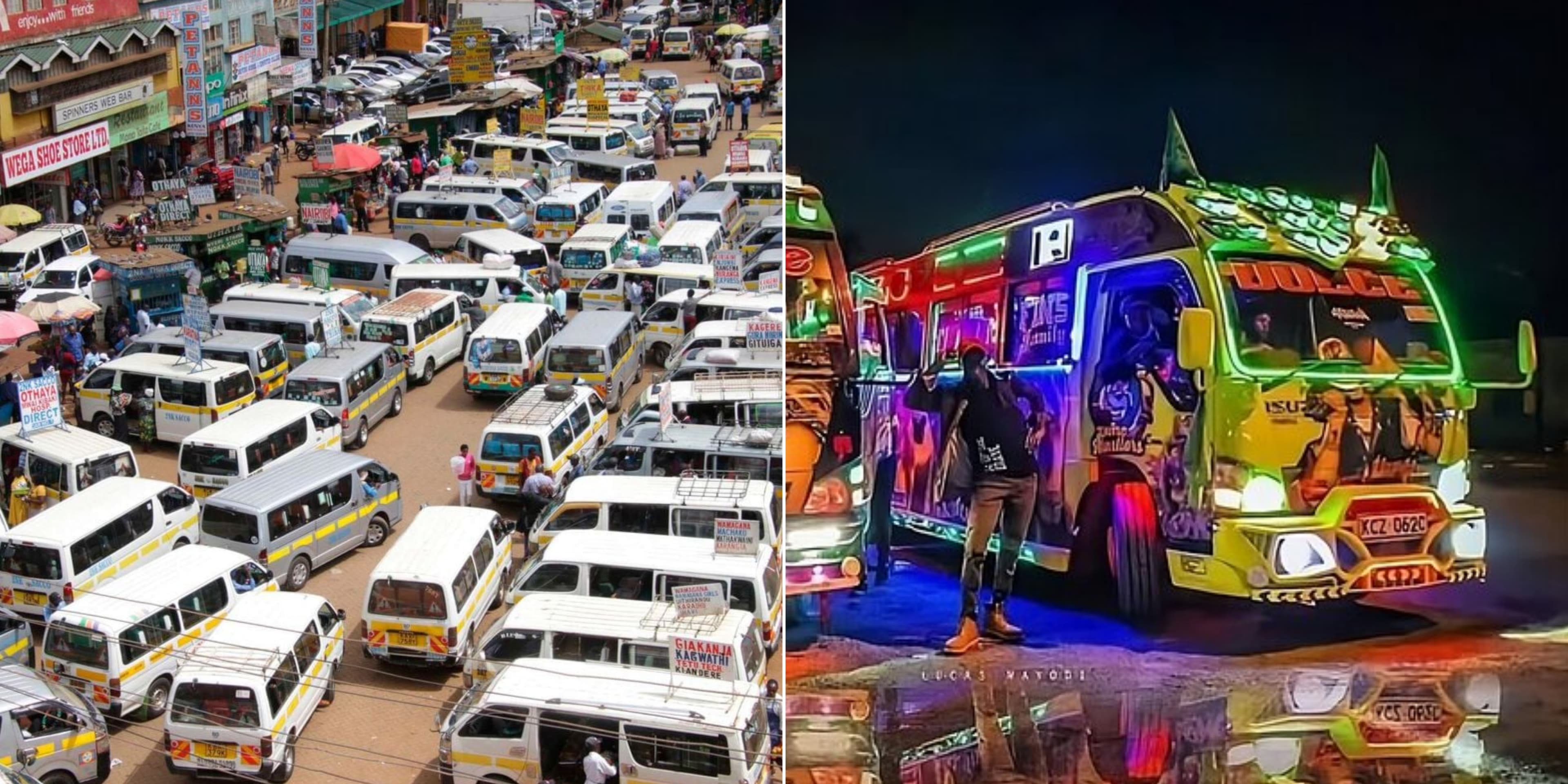

The Micro and Small Taxpayers Department aims to integrate four million new taxpayers by 2029, focusing on Kenya’s vast informal sector, which generates 85% of new jobs.

Simultaneously, the Business Strategy Technology and Enterprise Modernization Department will leverage AI, machine learning, and data analytics to streamline tax processes, curb evasion, and improve efficiency.

These reforms follow President William Ruto’s 2023 MSME Tax Base Expansion Taskforce recommendations, consolidating taxpayer categories while prioritizing previously underserved micro-businesses.

The initiative focuses on high-growth sectors like agribusiness and digital commerce but faces resistance. While digital transformation offers efficiency gains, its success depends on balancing enforcement with trust-building.

Small traders remain wary of increased oversight, and analysts warn that overly aggressive measures could stifle economic activity rather than drive sustainable tax expansion.